Admit it. When the federal government talks of investing huge sums of money into high-speed rail you picture aerodynamic bullet trains humming along at 220 miles per hour.

So when the government proclaims that it has invested $12 billion into "high-speed rail" you presume that those funds will be used to fund actual high-speed rail projects. Not so says CNN's Drew Griffin who has released another expose on where these funds are actually going.

To sum up Drew's report, the $12 billion dollars is being used to make conventional freight trains a wee bit faster. In essence, while the public was sold on bullet trains, the monies are really just being used to improve conventional rail lines.

The cornerstone of Drew's report is the fact that $800 million in taxpayer "high-speed rail" funds were used to improve conventional rail track between Seattle and Portland. The big pay-off? Shaving 10 minutes off the travel time.

The CNN video report can be seen here.

Wednesday, March 27, 2013

Friday, March 22, 2013

Is My Fresno County CSA 51/283 Tax Assessment Deductible as a Property Tax? (Part I)

Most everyone knows that regular annual property taxes are deductible for federal income tax purposes (ignoring AMT issues). However, what is often confusing to homeowners and tax preparers is the deductibility of certain extra one-time assessments used to fund public improvements (often called local benefit assessments).

For example, many homeowners that live in northern Fresno County live in an area referred to as County Service Area 51. CSA 51 was established to try to figure out if there was a viable way to bring city water to the low water areas of northern Fresno. CSA 51 ended up creating assessment district 283. Back in 2008 or so, the then residents of CSA 51 voted to have certain engineering plans drawn up to determine the feasibility of bringing water to that area--as part of this, it was agreed that the cost of such plans would be assessed to each parcel in the area (around $3,000 per house). Maps and plans were drawn up the final report indicated that it would cost each homeowner a whopping $50,000 or so to have water lines installed in the area. The CSA 51 residents then voted again in July of 2012 to see if the project (and the massive $50,000 per parcel assessment) would move forward. The measure ultimately failed.

The CSA 51 residents were left with engineering plans, a $3,000 per parcel assessment, but no water lines. Half of this $3,000 assessment (or around $1,500) recently showed up on homeowners' 2012-13 property tax bill (referred to as CSA ID 283), with the other half to be assessed next year.

The obvious question for the CSA 51 homeowners is "can I deduct this extra $1,500 in property taxes this year and again next?"

Unfortunately, the answer is NOT easy.

The deductibiliy of local benefit assessments really depends on the purpose of the assessment. Taxes assessed against local benefits of a kind tending to increase the value of the property are deductible as taxes only to the extent taxes are properly allocable to repairs, maintenance or interest charges. (Reg. 1.164-4(b).)

Thus, it has long been established that local assessments to build sewer or water lines, sidewalks, or irrigation lines benefiting a particular community, as opposed to the entire city or county, would be non-deductible. The idea is that these assessments benefited a select group of people and increased the values of their property.

However, the key fact in this case is that the project in CSA 51, never actually moved forward. Had the lines been built, there is no question that the initial $3,000 assessment and the additional $50,000 assessment would not have been deductible, but here, the operative question is whether or not the residents of CSA 51 have enjoyed some type of increase in value, simply by virtue of the fact that the county has had expensive engineering maps and plans drawn up.

Believe it or not, there is an old tax case from 1941 which addresses a similar situation (Thatcher v. Commissioner (1941) 45 BTA 64). In the Thatcher case a special assessment district was created to consider the installation of a sewer line in the neighborhood. After its creation, expenses were incurred for engineering services, attorney fees, and other expenses related to the planned sewer construction. As a result, general plans and maps were made, but the Court noted that there were no detailed plans for construction purposes. Shortly after, it was determined that the plan was misguided and the assessment district was disbanded. The question the court entertained was, what value did the residents get from these plans that had been drawn up. The residents claimed that because the construction was not moving forward, the plans held no value for future use and that they were simply paying for a "mistake in judgment". The IRS argued, however, that the plans and maps resulting from the expenditures had a value for future use and constituted a benefit to the residents.

The court ultimately relied on the fact that the construction project was not moving forward and stated as follows:

In other words, when the city determined that it was too expensive to feasibly construct sewer lines, this would actually have decreased the values of the home. In short, the court decided that while there may be some value to having plans drawn up, if the plans actually show you that the end goal is prohibitively expensive and the project is ultimately dropped, there can be no "benefit" to the residents. The residents won and were allowed to deduct the assessments

With respect to the residents of CSA 51, there is no clear answer. While the facts and circumstances of CSA 51 are similar to the Thatcher case, they are not identical.

For example, many homeowners that live in northern Fresno County live in an area referred to as County Service Area 51. CSA 51 was established to try to figure out if there was a viable way to bring city water to the low water areas of northern Fresno. CSA 51 ended up creating assessment district 283. Back in 2008 or so, the then residents of CSA 51 voted to have certain engineering plans drawn up to determine the feasibility of bringing water to that area--as part of this, it was agreed that the cost of such plans would be assessed to each parcel in the area (around $3,000 per house). Maps and plans were drawn up the final report indicated that it would cost each homeowner a whopping $50,000 or so to have water lines installed in the area. The CSA 51 residents then voted again in July of 2012 to see if the project (and the massive $50,000 per parcel assessment) would move forward. The measure ultimately failed.

The CSA 51 residents were left with engineering plans, a $3,000 per parcel assessment, but no water lines. Half of this $3,000 assessment (or around $1,500) recently showed up on homeowners' 2012-13 property tax bill (referred to as CSA ID 283), with the other half to be assessed next year.

The obvious question for the CSA 51 homeowners is "can I deduct this extra $1,500 in property taxes this year and again next?"

Unfortunately, the answer is NOT easy.

The deductibiliy of local benefit assessments really depends on the purpose of the assessment. Taxes assessed against local benefits of a kind tending to increase the value of the property are deductible as taxes only to the extent taxes are properly allocable to repairs, maintenance or interest charges. (Reg. 1.164-4(b).)

Thus, it has long been established that local assessments to build sewer or water lines, sidewalks, or irrigation lines benefiting a particular community, as opposed to the entire city or county, would be non-deductible. The idea is that these assessments benefited a select group of people and increased the values of their property.

However, the key fact in this case is that the project in CSA 51, never actually moved forward. Had the lines been built, there is no question that the initial $3,000 assessment and the additional $50,000 assessment would not have been deductible, but here, the operative question is whether or not the residents of CSA 51 have enjoyed some type of increase in value, simply by virtue of the fact that the county has had expensive engineering maps and plans drawn up.

Believe it or not, there is an old tax case from 1941 which addresses a similar situation (Thatcher v. Commissioner (1941) 45 BTA 64). In the Thatcher case a special assessment district was created to consider the installation of a sewer line in the neighborhood. After its creation, expenses were incurred for engineering services, attorney fees, and other expenses related to the planned sewer construction. As a result, general plans and maps were made, but the Court noted that there were no detailed plans for construction purposes. Shortly after, it was determined that the plan was misguided and the assessment district was disbanded. The question the court entertained was, what value did the residents get from these plans that had been drawn up. The residents claimed that because the construction was not moving forward, the plans held no value for future use and that they were simply paying for a "mistake in judgment". The IRS argued, however, that the plans and maps resulting from the expenditures had a value for future use and constituted a benefit to the residents.

The court ultimately relied on the fact that the construction project was not moving forward and stated as follows:

We do not agree with respondent's contention that the mere fact of the determination that the construction of a sewage system in the district was not feasible or too costly is a benefit. It may be a benefit to the present owner personally, in the sense that it will deter him from ever taking part in such a project again, but we can conceive of no reason for an increase in the value of the land by reason of a determination that it is not subject to sewage development except at a prohibitive cost. The natural effect of this, we think, is to decrease values.

In other words, when the city determined that it was too expensive to feasibly construct sewer lines, this would actually have decreased the values of the home. In short, the court decided that while there may be some value to having plans drawn up, if the plans actually show you that the end goal is prohibitively expensive and the project is ultimately dropped, there can be no "benefit" to the residents. The residents won and were allowed to deduct the assessments

With respect to the residents of CSA 51, there is no clear answer. While the facts and circumstances of CSA 51 are similar to the Thatcher case, they are not identical.

Thursday, March 21, 2013

The Tax Consequences of Superman's Diamonds

Chances are, you have often pondered the tax implications of Superman using his super human strength to turn coal into diamonds--which he has done on several occasions.

From the Tax Prof Blog:

[I]f Superman crushes carbon and makes diamonds, is that taxable income? ... There are two questions here. First, are the diamonds taxable income for Superman (or Clark Kent) and second, are they taxable income for a recipient such as Lois Lane?The answer to the first question is “probably not.” A traditional, almost fundamental principle of income tax is that a gain in value must be realized before it can be taxed. ...It seems clear that improving the value of the carbon is not such a taxable event, since there is neither a sale nor disposition of the property of any kind. An analogy might be made to a painting that appreciates in value; the increase in value is not taxed until the painting is sold, given away, etc.If the diamonds are given to Lois Lane, however, that is obviously a gift, which has its own set of special rules. In the US, gifts are generally not taxable income for the recipient. 26 USC 102(a). But there is a gift tax that is ordinarily paid by the giver. 26 USC 2501(a)(1) and 26 USC 2502(c). However, there is a significant exclusion for gifts that currently stands at $13,000 per-recipient per-year. Thus the question is, presuming the diamonds were given as a gift today, would they exceed the exclusion?Obviously this depends on the size and quality of the diamond and the state of the diamond market, but for example the diamond given to Lana Lang in Superman III appears to be about 3.5 to 4 carats and of very good quality. Looking at stones for sale on Blue Nile, a similar diamond would cost somewhere between $150,000 and $400,000, depending on the particulars, which is far beyond the gift exclusion. So how much would Superman be on the hook for? The answer is “a lot.” ...Superman could theoretically avoid gift tax liability by performing the gratuitous service of crushing coal into diamonds rather than giving a finished diamond. Although it is true that gratuitous services are not taxed, it is also true that the IRS and the courts frown on tax avoidance schemes that attempt to exalt form over substance. Gregory v. Helvering, 293 U.S. 465 (1935). So a scheme by which Superman handed someone a piece of coal, fully intending to turn it into a diamond, then did so, would be tantamount to simply giving them a diamond. The IRS would focus on the substance of the transaction, not the form, and consider it a taxable gift of property.But if, for example, Superman were at someone’s house for a barbecue and decided to thank them for dinner by crushing a lump of their own charcoal into a diamond, that would be different. In that case Superman really would be performing a gratuitous service. ...Superman has crushed coal into diamonds for various reasons, but one of the best known was his gift of a ring to Lana Lang in Superman III. This raises an interesting question: is an engagement ring subject to gift tax? There is, subject to certain qualifications, an unlimited marital deduction for gifts between spouses, but what about an engagement ring, which is given in anticipation of marriage?The law surrounding engagement rings and other pre-nuptial gifts has a long and complex history, dating back to at least the Romans. Most of the law has to do with who owns such gifts, particularly if the marriage is called off. But it turns out that none of that matters for tax purposes. If the donor and donee aren’t married at the time of the gift, then the marital deduction doesn’t apply. 26 U.S.C. § 2523(a). So an engagement ring is subject to gift tax, even if the donor and donee get married later that same year. In practice I suspect that few people actually report such gifts, even in the rare case where it would make a difference in their ultimate tax liability, but maybe Superman would actually be moral enough to do so.Crushing coal into diamonds still doesn’t create tax liability for Superman, and he still has some ways to avoid liability if he crushes coal into diamonds for other people, but he has to be careful about it. And strictly speaking he probably should have reported that ring he gave to Lana.

Saturday, March 16, 2013

A Depressing Look at the CA Sec. of State's Office: why it takes CA 43 days to do what TX does in 5

I've always wondered why it takes week for the CA Sec. of State's Office to process business filings. Often these delays prevent business owners from getting licenses and opening bank accounts. I was surprised to learn (not really though) that it only takes New York seven days and Texas five days to process similar filings.

Recently, Debra Bowen, the Secretary of State was grilled in front of the CA legislature and it wasn't a pretty picture. It revealed an office so out of date that it actually relies on 3 x 5 index cards as its filing system.

More from the OC Register:

Recently, Debra Bowen, the Secretary of State was grilled in front of the CA legislature and it wasn't a pretty picture. It revealed an office so out of date that it actually relies on 3 x 5 index cards as its filing system.

More from the OC Register:

"I almost needed smelling salts the first day I took a tour of the Secretary of State's office," said Bowen, a former Marina Del Rey legislator who was first elected California's chief elections officer and business records clerk in 2006. "It was just so incredibly paper-driven."

Bowen's office has taken heat in recent days after it was revealed that her staff was taking 43 days to process business filings. As Assembly Budget Committee staff reported, this backlog delays businesses from starting up or hiring employees and postpones business tax payments.

New York processes such documents in seven days, committee staff found. Texas, five days.

"There is a scoreboard," Daly said, referring to the other states' better turnaround times. "At some point, the time for excuses is over."

Bowen says her office needs $8.9 million in new money over the next fiscal year, and millions more after that, to fund dozens of new staff positions necessary to handle the workload and reduce the backlog until a new, digital filing system comes online in 2016.

That new system, known as California Business Connect, will create a central records database and put the Secretary of State's services on the Internet. But Bowen complained that the state's procurement process is needlessly protracted and requires her to spend "a ridiculous amount of money" just on the paperwork to "get the project on the docket to get done."

"We spend a year getting the feasibility report done. Then it takes a several months after that to hire a contractor to write the request for proposal. That's another three to four months – it could be even longer than that," Bowen told the subcommittee. "That one was approved by the Legislature in July of 2011. The request for proposal, the RFP, was released in August 2012. Draft bids from vendors were submitted in late January of this year and are currently being reviewed.

"So ... the normal processing time for a large IT project ... you get to 2016," she said. "That has to be changed."

Further complicating matters, Bowen said, is her office building's lack of outlets and her staff's requirement to use the state Department of General Services to procure rewiring services. She specifically asked the committee for authority to pursue the rewiring on her own, without the assistance of the department, which acts as the "business manager" for other state agencies.

Friday, March 15, 2013

Explaining the Debt Limit: How an Absurd Video Makes the Debit Limit Debate Understandable

This video is a must see and pretty much explains itself:

Tuesday, March 12, 2013

California Fire Prevention Fees Are Not Tax Deductible Says IRS

California has begun mailing bills to rural property owners for fire prevention. If you own habitable property the CalFire's jurisdiction, you will eventually receive two bills this year--one for the State's 2011-2012 fiscal year, and one for its 2012-2013 fiscal year.

Each bill will be $150 per habitable structure on your property. So if you have one house on your property and no other habitable structures, you will receive two bills this year totaling $300.

The Howard Jarvis Taxpayer Association warns:

Unfortunately, it appears the IRS has taken the position in a recent Memorandum that such payments are not deductible property taxes.

Office of Chief Counsel, IRS Memorandum 2013-10-029 (Jan. 14, 2013) (released Mar. 8, 2013):

Each bill will be $150 per habitable structure on your property. So if you have one house on your property and no other habitable structures, you will receive two bills this year totaling $300.

The Howard Jarvis Taxpayer Association warns:

PAY CLOSE ATTENTION TO THE DUE DATE. You may have fewer than 30 days to pay. If you are late, there is a 20% penalty, plus interest. Every 30 days after that, another 20% penalty is added, plus interest. The fee is a lien on your property, and failure to pay can result in foreclosure.

Unfortunately, it appears the IRS has taken the position in a recent Memorandum that such payments are not deductible property taxes.

Office of Chief Counsel, IRS Memorandum 2013-10-029 (Jan. 14, 2013) (released Mar. 8, 2013):

Issue: May California residents deduct the Fire Prevention Fee they may pay on their federal income tax returns as a real property tax deduction under section 164 of the Internal Revenue Code and § 1.164-4 of the Income Tax Regulations?Conclusion: California residents may not deduct the Fire Prevention Fee as a real property tax deduction because (i) the fee is not a tax under California or federal law (ii) the fee is not levied at a like rate, (iii) the fee is not imposed throughout the taxing authority's jurisdiction, and (iv) the fee is assessed only against specific property to provide a local benefit

Thursday, March 7, 2013

Camp Taylor--Helping Kids With Heart Disease

Michael Goldring from our office and his daughter, Rachael, were featured on KSEE 24 recently to talk about heat disease on how children who suffer from it can benefit from Camp Taylor.

Click here for their video appearance.

Click here for their video appearance.

Friday, March 1, 2013

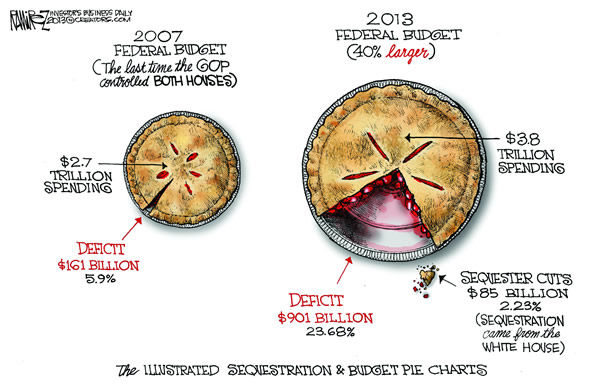

A Sequestration Visual Aid

Cartoonist Michael Ramirez offers a helpful visual of the level of planned cuts under Sequestration.

Pies Illustrated, by Michael Ramirez (February 26, 2013)

Boomerang, by Michael Ramirez (February 25, 2013)

Oscars Red Carpet, by Henry Payne (February 23, 2013)

Subscribe to:

Posts (Atom)