Tuesday, August 6, 2013

All Blog Posts Now Under New Site

I have moved my blog over to FLGZ's main website. It can be reached by following this link. Please add your email address at the top of that page to subscribe to future blog posts.

Friday, July 12, 2013

Wednesday, July 3, 2013

Ohio Tea Party to Challenge Executive Salaries of Nonprofit Hospitals in Fight Against Medicaid Expansion

From the Associated Press:

In a confidential email sent to fellow Ohio tea party leaders and obtained by The Associated Press, Tom Zawistowski laid out a strategy for invoking a little-known IRS provision that allows citizens to challenge executive salaries and the nonprofit statuses of charitable hospitals. ...

Zawistowski identifies the hospitals as big backers of expanded Medicaid. His email said tea party groups will “make Medicaid personal” by publicizing large salaries of those seeking federal money to help the poor.

...

“The goal is to change the narrative,” Zawistowski wrote. Rather than have people wondering why tea party groups don’t want to help the poor, they should wonder why hospitals need more federal tax dollars to care for the poor when they’ve got plenty of cash on hand, he wrote.

Zawistowski said by phone that [Ohio Governor Kasich] has “hauled out” hospital CEOs at pro-Medicaid rallies that are making millions of dollars. In his emails, he singles out the $2.5 million salary of Cleveland Clinic CEO Toby Cosgrove, whose nonprofit hospital had more than $9 billion in assets in 2011.

“This guy’s making $2 million a year, pleading poverty to help poor people,” he said. “It just seems a little disingenuous to us in the tea party who volunteer for nothing. We’re curious to see their definition of poverty.”

Friday, June 28, 2013

Don't Make Section 501(c)(4) The Patsy of the IRS Scandal

The Visalia Times-Delta recently published an editorial of mine defending section 501(c)(4) organizations that have been vilified as of late as a reactionary response to the IRS tea party scandal. I defend both their tax-exempt status and the fact that donors' names are kept confidential.

Thursday, June 27, 2013

How the Prop 8 Ruling Threatens Prop 13 (and other future tax reforms)

California's ballot initiative process is vital to Californians and helps ensure that the will of the people is expressed, even when California politicians are uncooperative. Over the years, ballot initiatives have been proposed and passed that have advanced both liberal and conservative causes. In each of these cases, the initiative process was the only way to advance these issues as the legislature would not, or could not, pass effective legislation.

While the recent Supreme Court case on Proposition 8 may have advanced gay marriage, its unintended consequence is to put into question the sustainability and power of future ballot initiatives. Justice Scalia ruled, in essence, that the defenders of the Prop 8 initiative did not have standing to sue because only the State of California had standing to defend Prop 8 from attacks. While Gov. Brown and Kamala Harris, the State A.G., put up a begrudging defense of Prop 8 at the trial level, they opted not to appeal the trial court decision finding Prop 8 unconstitutional. Defenders of Prop 8 then stepped in and decided to appeal. The California Supreme Court held that clearly, the Prop 8 defenders had standing and could appeal the decision and were essentially representing the interests of the State.

Unfortunately, Justice Scalia's holding now weakens almost any ballot initiative--especially those that the Governor and Attorney General personally dislike. Consider the following hypothetical. A homeowner sues alleging that Prop 13 violates their equal protection because their neighbor who bought their home 50 years ago pays much less than they do for their new home, despite the fact the homes are identical and have the same value. Although merit less, the Governor and state AG could opt to not defend the suit. All of a sudden, an injunction is issued finding Prop 13 to be unconstitutional. The State decides it won't pursue an appeal and the defenders of Prop 13 have no standing in federal court to pursue an appeal either.

In a single opinion, Justice Scalia was able to do something many California politicians have been trying to do for year--weaken the initiative process.

While the recent Supreme Court case on Proposition 8 may have advanced gay marriage, its unintended consequence is to put into question the sustainability and power of future ballot initiatives. Justice Scalia ruled, in essence, that the defenders of the Prop 8 initiative did not have standing to sue because only the State of California had standing to defend Prop 8 from attacks. While Gov. Brown and Kamala Harris, the State A.G., put up a begrudging defense of Prop 8 at the trial level, they opted not to appeal the trial court decision finding Prop 8 unconstitutional. Defenders of Prop 8 then stepped in and decided to appeal. The California Supreme Court held that clearly, the Prop 8 defenders had standing and could appeal the decision and were essentially representing the interests of the State.

Unfortunately, Justice Scalia's holding now weakens almost any ballot initiative--especially those that the Governor and Attorney General personally dislike. Consider the following hypothetical. A homeowner sues alleging that Prop 13 violates their equal protection because their neighbor who bought their home 50 years ago pays much less than they do for their new home, despite the fact the homes are identical and have the same value. Although merit less, the Governor and state AG could opt to not defend the suit. All of a sudden, an injunction is issued finding Prop 13 to be unconstitutional. The State decides it won't pursue an appeal and the defenders of Prop 13 have no standing in federal court to pursue an appeal either.

In a single opinion, Justice Scalia was able to do something many California politicians have been trying to do for year--weaken the initiative process.

Monday, June 24, 2013

IRS Sent $7,319,518 in Refunds to a Sinlge Bank Account Used by 2,706 Aliens

According to a recent audit report by the Treasury Inspector General, the IRS sent $7,219,518 in tax refunds in 2011 to what where--at least on paper--2,706 different aliens who were not authorized to work inside the United States. Unbelievably, all the funds were deposited into a single account.

In terms of strengthening fraud and theft detection, you would think that stopping this type of obvious abuse would be the "low-hanging fruit".

In terms of strengthening fraud and theft detection, you would think that stopping this type of obvious abuse would be the "low-hanging fruit".

Thursday, June 20, 2013

IRS FBAR Tax Forms Due June 30

Chances are, if you immigrated to the U.S. or if you travel frequently abroad, you have a foreign bank account. However, what most don't know is that you must take active steps to notify the IRS of these foreign accounts even if they are not earning any income. Failure to do so can lead to massive penalties. In particular, the penalty for knowingly failing to file the requisite form is up to 50% of the total value of the account.

What must be filed is referred to as an FBAR, and it must be received by the IRS by June 30th. If you have failed to file FBARs in the past then there are ways to come into compliance at a minimal tax cost. Keep in mind that foreign banks are now repeatedly turning over U.S. account holder information to the DOJ and IRS and so the notion of a "secret" foreign account (Swiss or otherwise) is a thing of the past. If the IRS discovers the account before you come clean, it is likely that the penalties and interest will exceed the value in the account, even if absolutely no taxable income was earned by the account.

What must be filed is referred to as an FBAR, and it must be received by the IRS by June 30th. If you have failed to file FBARs in the past then there are ways to come into compliance at a minimal tax cost. Keep in mind that foreign banks are now repeatedly turning over U.S. account holder information to the DOJ and IRS and so the notion of a "secret" foreign account (Swiss or otherwise) is a thing of the past. If the IRS discovers the account before you come clean, it is likely that the penalties and interest will exceed the value in the account, even if absolutely no taxable income was earned by the account.

Tuesday, June 18, 2013

Tax Avoidance Sinful, Says UK Archbishop Ahead of G8 Summit

Tax avoidance is "sinful" and tantamount to robbery, says Archbishop John Sentamu, one of the UK's most senior clerics, as G8 leaders prepare to discuss the issue.

From the BBC:

From the BBC:

Dr John Sentamu, the Archbishop of York, told the BBC that individuals and companies needed to be held accountable for their actions when it came to tax.

Tax avoidance was hindering efforts to tackle hunger and malnutrition in developing countries, he suggested.

Business has urged politicians to focus on setting laws and not "moralising".

Tax avoidance was "definitely a moral issue", the archbishop said and asked whether it was sinful, he replied: "It is sinful, simply because Jesus was very clear; pay to Caesar what belongs to Caesar and to God what belongs to God."

Those not paying their full tax liabilities were "not only robbing the poor of what they could be getting, they are actually robbing God, because God says 'bring into my store house all the tithes'".

"So if God has told us to be just, to walk humbly and to be merciful and then we behave in a very strange way - God is being robbed, the world is being robbed, your neighbour is being robbed."

Business organisations have warned politicians against "moralising" about the issue and said it is the task of governments to set the laws regarding tax and for firms to abide by them. Google, Amazon and Thames Water all insist they are complying fully with the law.

Tuesday, June 11, 2013

So The Problem Is Not Just IRS Lawyers... It's All Government Lawyers?

There is a great article by Robert Anderson (Pepperdine) on how the IRS is just a microcosm of nearly all federal agencies. In a sense, the problem is not just IRS lawyers, but ALL government lawyers. He points out that 95% of IRS lawyers who contributed to last election's candidates contributed to President Obama--but surprisingly this lopsided giving is not out of the ordinary for government lawyers across nearly all agencies.

See below for relevant portions:

I searched the Federal Election Commission database for contributors with the term "lawyer" or "attorney" in thee occupation field. I then sorted the results by government agency (including the many permutations of agency names in the database). This produced a list of 20 federal agencies with at least 20 employees contributing to either Barack Obama or Mitt Romney in the 2012 election.(Hat Tip: Tax Prof Blog)

The results for the IRS were striking. Of the IRS lawyers who made contributions in the 2012 election, 95% contributed to Obama rather than to Romney. So among IRS lawyers, the ratio of Obama contributors to Romney contributors was not merely 4-to-1 at previously reported, but more like 20-to-1. The ratio of funds to Obama was even more lopsided, with about 32 times as much money going to Obama as to Romney from IRS lawyers.

So has the IRS gone off the rails into hyper-partisanship, leaving behind other more balanced federal agencies? ... The data show, however, that the partisanship of the lawyers in the IRS is not unusual or even particularly extreme among federal agencies. In fact, the lawyers in every single federal government agency--from the Department of Education [100%] to the Department of Defense [68%] -- contributed overwhelmingly to Obama compared to Romney. The table below shows the results for all agencies with at least 20 employees who contributed to either Obama or Romney. ...

Friday, June 7, 2013

The IRS Targeting Scandal--An Engaging Infographic

Below is a fascinating infographic that attempts to fill-in the details and give the back story of the IRS tea-party targeting scandal. (admittedly the tone is a bit left-leaning)

Source: TopAccountingDegrees.org

Source: TopAccountingDegrees.org

Wednesday, June 5, 2013

Am I Liable for my New Spouse's Old Tax Debts?

I get this question a lot from recent newly weds. Often, one of the spouses has racked up a massive tax bill and the "nonliable" spouse is worried that his or her assets will now be subject to IRS lien and levy procedures.

If you've just gotten married and your spouse's tax debts arose prior to marriage then you will have to work through a maze of California State and Federal rules to determine whether your assets can be attached by the IRS.

First, it is helpful to keep in mind that under federal law, the IRS (as a creditor) steps into the shows of the taxpayer and that state law determines a taxpayer's property rights to property. Because a federal tax lien against one spouse attaches to all of that taxpayer's property and rights to property in a community property state, the lien would attach to the liable spouse's one-half ownership interest in all items of community property.

In addition, in California, often times a private creditor has the right to collect a debt from all or part of both spouses' interests in community property. (See Fam. Code 910.) In other words, California is known as a 100% State, which means that the IRS (like other creditors) can collect from 100% of the community property for all the premarital tax debts of a spouse.

California does make a key exception to the nonliable spouse's wages that are earned after the marriage. As long as these wages are deposited into an account only in the nonliable spouse's name (and over which the liable spouse has no control or access and has not commingled funds), then these assets will not be subject to levy. (See Fam. Code 911.) However, if these funds are then used to purchase real property or vehicles, then such assets would then be subject to potential IRS lien and levy.

One way to protect additional community property assets would be to have the couple enter into a post-nuptial agreement whereby the spouse with tax issues would waive any community property interest in the other spouse's future earnings or property. Of course, this should only be done after careful consideration of all the relevant facts and circumstances and may be subject to challenge by the IRS as a fraudulent transfer.

If you've just gotten married and your spouse's tax debts arose prior to marriage then you will have to work through a maze of California State and Federal rules to determine whether your assets can be attached by the IRS.

First, it is helpful to keep in mind that under federal law, the IRS (as a creditor) steps into the shows of the taxpayer and that state law determines a taxpayer's property rights to property. Because a federal tax lien against one spouse attaches to all of that taxpayer's property and rights to property in a community property state, the lien would attach to the liable spouse's one-half ownership interest in all items of community property.

In addition, in California, often times a private creditor has the right to collect a debt from all or part of both spouses' interests in community property. (See Fam. Code 910.) In other words, California is known as a 100% State, which means that the IRS (like other creditors) can collect from 100% of the community property for all the premarital tax debts of a spouse.

California does make a key exception to the nonliable spouse's wages that are earned after the marriage. As long as these wages are deposited into an account only in the nonliable spouse's name (and over which the liable spouse has no control or access and has not commingled funds), then these assets will not be subject to levy. (See Fam. Code 911.) However, if these funds are then used to purchase real property or vehicles, then such assets would then be subject to potential IRS lien and levy.

One way to protect additional community property assets would be to have the couple enter into a post-nuptial agreement whereby the spouse with tax issues would waive any community property interest in the other spouse's future earnings or property. Of course, this should only be done after careful consideration of all the relevant facts and circumstances and may be subject to challenge by the IRS as a fraudulent transfer.

Sunday, June 2, 2013

IRS Scandal Extends to Gift Tax Return Abuse

Saturday's Wall Street Journal has a remarkable article disclosing that at the same time the IRS was subjecting tea-party groups to extra scrutiny, it also targeted tea-party donors by taking the unusual step of trying to impose gift taxes on donations to these groups.

In February 2010, the same month the tea-party targeting started, according to a recent inspector general's report, Freedom's Watch [a prominent conservative 501(c)(4)] was subjected to an IRS audit that focused largely on its political activities, an uncommon but not unprecedented action, election lawyers say. The probe broadened into other areas, including executive compensation.

About a year later, as many as five donors to Freedom's Watch were subjected to IRS audits of their contributions that sought to impose gift taxes on their donations to the group, according to lawyers and former officials of Freedom's Watch.

Believe it or not, the question of whether donations to tax-exempt groups like 501(c)(4)s are subject to the gift tax isn't necessarily settled law. The generally accepted protocol, however, was that if a donation was to a tax-exempt entity the IRS would not allege that gift taxes would apply.

Thursday, May 23, 2013

How to Fix the Prop 13 Loophole Without Harming CA Businesses

As of late, much has been written about Proposition 13—the 1978 ballot initiative that keeps property taxes low for landowners, whether they be residential homeowners or commercial landlords. Under Proposition 13, real property is only to be reassessed when there is a “change of ownership”. For residential homeowners, the rule is relatively simple to apply—if you sell or transfer your home, the property will likely be reassessed. However, when property is owned by a business, the rules become extremely complex and contain a gaping loophole.

This loophole recently gained widespread attention when computer billionaire Michael Dell restructured the purchase of the Fairmont Miramar hotel to avoid triggering a reassessment of the property—a move which saved him an estimated $1 million a year in property taxes. His strategy involved buying the business that owned the hotel in such a manner so as to ensure that no single person or entity held more than a 50% interest in the business. And so, effectively, Michael Dell, Dell’s wife, and another entity took ownership in the entity, but none of them acquired more than a 50% stake. This maneuver brought justified outrage—not only from the left, but even the head of the Howard Jarvis Taxpayer Association—the very group that helped ensure Proposition 13’s original passage said that Dell was “gaming the system”.

Unfortunately, many long-time Proposition 13 critics are using this extreme circumstance to attempt to repeal, or effectively gut, the protections afforded by Proposition 13. The most common “fix” offered by proponents is to only apply the generous rules of Proposition 13 to residential properties and to carve-out commercial properties, allowing commercial properties to be reassessed each year (a position apparently supported by most of the State's editorial board).

While this approach may seem tempting to those who yearn for higher tax revenues, when one takes into account that California already has the highest income tax, the highest sales tax, the highest gasoline tax and one of the highest corporate taxes in the Nation, it is apparent that California’s budgetary ills are not wholly attributable to “low” revenues.

Recently, Assemblyman Tom Ammiano (D-San Francisco) introduced a bill (AB 188) that sought to close the loophole and would require a reassessment if 100% of a business were sold or transferred within three years. While this bill is a good start, the fatal flaw of this bill, however, is that it can easily be planned around (e.g., one can structure the business sale to take just over three years or acquire up to 99.9% of the business ownership without triggering reassessment).

There is, however, a way that the Proposition 13 loophole can be permanently closed so that the tax rules are applied fairly across the board while at the same time ensuring that businesses are not hit with increasing property taxes as property values increase.

This can be accomplished by amending the applicable statutes to provide that when an original owner or owners of a property transfers, either in a single instance or cumulatively, more than 50% of his or her or their business, then all real property owned by that business will be reassessed. From that point forward, those owners will then be considered the original owners and whenever more than 50% of the business interests are again transferred there will be another reassessment.

Tuesday, May 21, 2013

The Darkside of IRS Automation

In early 2000, the IRS underwent a drastic overhaul in response to tremendous congressional pressures. They started to adopt the language and organization of business and management. Taxpayers were no longer just taxpayers, they were "customers". Part of this shift focused on "efficiencies" and introducing automated processes. The thinking at the time was that this would make it easier and efficient for both the IRS and its "customers".

I recent lecture by the National Taxpayer Advocate, Nina Olson, however, is chilling and paints a gloomy picture of what lies ahead. It presents what may be one of the greatest threats to the IRS, and its customers, to date. Her most poignant comments were as follows:

I recent lecture by the National Taxpayer Advocate, Nina Olson, however, is chilling and paints a gloomy picture of what lies ahead. It presents what may be one of the greatest threats to the IRS, and its customers, to date. Her most poignant comments were as follows:

I believe that the IRS is at a turning point, and for a number of reasons, we are beginning the slide to a radically different IRS from that which many of us in the room today practiced before or worked in just a decade or two ago. I believe that unless we act to change that trend, the IRS of tomorrow will have little personal interaction with taxpayers. . . . It will relentlessly drive forward on a path of more automation mostly to make its own work more convenient and rarely more helpful or tailored to the taxpayer. . . . It enables the IRS to ignore the humanity of taxpayers. [Emphasis in original.]I can attest from personal experience that the average John Q. Taxpayer can be absolutely be trapped in the IRS "system" and find it difficult, it not impossible, to get answers or guidance. Often cases languish waiting for agents to be assigned or for appeals case officers to be assigned. Frequently, all a taxpayer can do is call up the IRS hot-line, sit on hold for 30 minutes, and then talk to an IRS agent over the phone who can't assist them, let alone provide them with any helpful suggestions.

Wednesday, May 15, 2013

Vote For "La Wendy"--Worst Political Support Song Ever Written

Democratic LA mayoral candidate Wendy Greuel has received heavy union support compared to fellow democratic candidate Eric Garcetti.

In perhaps the worst demonstration of political support the LA hotel workers union wrote and sang a song urging citizens to vote for "la Wendy". Union officials translated the Spanish lyrics into English. Here's a portion of the words:

"If for la Wendy you want to vote

Get in the car and let's have fun.

And for la Wendy to win

All Latinos got to have her back.

If you want to earn $15 an hour

You have to march for la Wendy.

If the blond comes to your door

Open the door and let her in.

Wendy, la Wendy we're gonna vote.

$15 an hour we'll make.

Wendy, la Wendy we're gonna dance.

Eric Garcetti start crying.

From Montecito to Huntington Park

Passing El Sereno, eating tamales

And the voters for you will fight.

We'll have extra money to spend.

The people will support you.

That's why the blond will triumph.

In the truck we'll celebrate

With the mariachis we'll sing

Her last name is difficult to sing

That's why we're writing this rhyme.

La Wendy, Los Angeles you will change

And the Latino vote will crown you."

In perhaps the worst demonstration of political support the LA hotel workers union wrote and sang a song urging citizens to vote for "la Wendy". Union officials translated the Spanish lyrics into English. Here's a portion of the words:

"If for la Wendy you want to vote

Get in the car and let's have fun.

And for la Wendy to win

All Latinos got to have her back.

If you want to earn $15 an hour

You have to march for la Wendy.

If the blond comes to your door

Open the door and let her in.

Wendy, la Wendy we're gonna vote.

$15 an hour we'll make.

Wendy, la Wendy we're gonna dance.

Eric Garcetti start crying.

From Montecito to Huntington Park

Passing El Sereno, eating tamales

And the voters for you will fight.

We'll have extra money to spend.

The people will support you.

That's why the blond will triumph.

In the truck we'll celebrate

With the mariachis we'll sing

Her last name is difficult to sing

That's why we're writing this rhyme.

La Wendy, Los Angeles you will change

And the Latino vote will crown you."

Monday, May 13, 2013

A Rational Explanation for the Targeting of Tea Party Groups by the IRS?

Although the inspector general of the U.S. Treasury is set to release a report on Wednesday detailing the increased scrutiny certain tea party groups received in their 501(c)(4) applications, a Duke tax law professor, Richard Schmalbeck, was at the ABA meeting where this was first disclosed and has shared his thoughts:

From the Tax Prof Blog:

American Thinker: IRS Scandal Deepens: High Officials Knew of Tea Party Targeting in 2011

CNN: IRS Abuses Power in Targeting Tea Party

Fox News: Republicans Slam IRS Targeting of Tea Party as 'Chilling,' a Form of Intimidation

The Hill: Rep. Issa: IRS apology to Tea Party Groups ‘Not an Honest One’

Legal Insurrection: IRS Reaped Hatred of Tea Party Sown by Democrats and the Media, by William Jacobson (Cornell)

Legal Insurrection: The Washington Post leads on the #IRScandal ... Who Will Follow?

Mother Jones: The IRS Shoots Itself in the Foot, Then Reloads

New York Post: The Nixon Wing at the IRS

New York Times: IRS Focus on Conservatives Gives G.O.P. an Issue to Seize On

Politico: 5 Questions on the IRS Debacle

Reuters: IRS Kept Shifting Targets in Tax-Exempt Groups Scrutiny: Report

The Volokh Conspiracy: IRS Scrutinized Teaching the Constitution, by Jonathan Adler (Case Western)

Wall Street Journal: Wider Problems Found at IRS: Probe Says Tax Agency Used Sweeping Criteria to Scrutinize Conservative Groups

Washington Examiner: Conservatives Want Congress to Audit IRS for Targeting Tea Party

Washington Post: IRS Targeted Groups That Criticized the Government, IG Report Says

Washington Tims: IRS Scandal Grows to Include Debt Critics

From the Tax Prof Blog:

I was at the Exempt Organizations Committee meeting of the ABA Tax Section meeting when Lois Lerner, the director of the division that handles exempt organizations matters, dropped the bombshell that is in the papers today, and generating a lot of media outrage, especially but not exclusively on Fox News. I think her explanation in person was probably better than the statement that the IRS released, at least in terms of explaining why some exemption applications actually require more scrutiny than others.

The IRS position on 501(c)(4) organizations ("social welfare organizations")is that, while they can engage in campaign activities, they cannot do so as their primary activity—which they understand as more than 50% of the organization's activities. Many organizations that seek this status probably should be section 527 political organizations rather than social welfare organizations. So when the service center in Cincinnati, which handles exemption applications, was inundated with unusually large numbers of (c)(4) applications, they tried to find ways to triage them, so that the traditional social welfare organizations would not have their processing held up, but organizations that might be close to the 50% campaign activity zone would get the appropriate level of scrutiny. In developing ways to identify the applications requiring attention, one of the tests that somebody decided would work is whether the organization had "tea party" or "patriot" in its name. The IRS did also look at other organizations with potential for abuse of the social welfare organization status, but apparently did not come up with any shorthand ways of identifying any such organizations that did not have "tea party" or "patriot" in their names.This was obviously a bad idea for a number of reasons, including its political asymmetry. But a) it didn't come from the top—Lois is herself a career employee, and it was a decision made somewhere below her level; and b) it did not involve scrutiny that was inappropriate under the circumstances. The content of some of the scrutiny may have been inappropriate, however, in seeking names of donors, which is not ordinarily done. (Even here, I can imagine some basis for thinking this was relevant to the inquiry: if all an organization's funds were coming from a party, or other 527 organizations, it would be a matter of some concern, and raise a somewhat higher suspicion that the organization was being used to finance campaign activities primarily. And while public disclosure of donors is not required, there is no absolute bar on the IRS seeking information about donors. They do it routinely in their efforts to determine private foundation status and compliance, since major donors are disqualified persons for purposes of the private foundation excise taxes. I should emphasize that Lois did not offer this explanation however—it is just my speculation on why IRS staff might have asked that question.)

Some additional headlines on this matter:I think the problem is that if you hear that tea party organizations were "targeted" for special scrutiny, it is hard to imagine an explanation that doesn't depend on partisan bias. But there is such an explanation: the need to draw the line between (c)(4) and 527 organizations. I'm not saying that this was the right way to go about this, and neither is Lois or anyone else in the IRS. But at the same time, it isn't the smoking gun that some in the media seem to think it is. It is nothing like Richard Nixon asking the IRS to audit his political enemies, though it is being compared to that.

American Thinker: IRS Scandal Deepens: High Officials Knew of Tea Party Targeting in 2011

Wednesday, May 8, 2013

Happy Mother's Day! Son Tries to Deduct Over $1MM in Legal Fees to Parents

So how much would you pay to have your child take care of you when you’re old and infirm?

According to one tax attorney, $1.2 million. At least that is the take away from Estate of Olivo v. Commissioner.

"The court considered whether mom’s estate could deduct $1,240,000 for son’s services before mom died. Tax lawyer Anthony Olivo worked in law firms from 1976 to 1988, then opened his own practice.

Yet by 1994, he was devoting so much time to his parents and their health problems that it was hard to maintain his practice. He lived with his parents and gave them round-the-clock care. That left little time to practice law, so from 1994 through 2003, he earned almost nothing from his practice.

So when they died he figured the estate should pay him all those lost wages. Hey, it’s deductible, he said. The court had to decide whether the estate could deduct the $1,240,000. On top of that was the $44,200 administrator’s commission Anthony received, not to mention $55,000 in accountant’s and attorney’s fees.

The court was careful to say that Anthony rendered extraordinary care. Hey, this was a doting son. His efforts were commendable. However, mom’s estate couldn’t prove that Anthony was entitled to any pay or how much his services were worth.

There was no contract, no invoice, and no evidence the family agreed to pay him anything. Sure, Anthony gave round-the-clock care. The family would have hired round-the-clock nurses if he hadn’t been there.

But he was, and the fact that a nurse would have been paid didn’t mean pay to Anthony was deductible. Anthony even considered billing the estate for his legal services.

After all, apart from his personal care and for administering the estate, he performed legal work too. He filed the estate tax return, handled an IRS audit and the estate’s Tax Court petition.

But here again, Anthony was out of luck. He didn’t keep time records, prepare invoices, or establish the value of what he did. He merely estimated his hours at a $150 hourly rate. That kind of loosey-goosey estimate wasn’t enough for a deduction.

The biggest lesson? Contracts, invoices, and good record-keeping are as important with family or related parties as anywhere else. In fact, perhaps there’s a bigger reason for being scrupulous with family and related parties: to save yourself headaches with the IRS. Happy Mother’s Day, Mom."

(Hat Tip: Attorney Robert Wood of Forbes)

According to one tax attorney, $1.2 million. At least that is the take away from Estate of Olivo v. Commissioner.

"The court considered whether mom’s estate could deduct $1,240,000 for son’s services before mom died. Tax lawyer Anthony Olivo worked in law firms from 1976 to 1988, then opened his own practice.

Yet by 1994, he was devoting so much time to his parents and their health problems that it was hard to maintain his practice. He lived with his parents and gave them round-the-clock care. That left little time to practice law, so from 1994 through 2003, he earned almost nothing from his practice.

So when they died he figured the estate should pay him all those lost wages. Hey, it’s deductible, he said. The court had to decide whether the estate could deduct the $1,240,000. On top of that was the $44,200 administrator’s commission Anthony received, not to mention $55,000 in accountant’s and attorney’s fees.

The court was careful to say that Anthony rendered extraordinary care. Hey, this was a doting son. His efforts were commendable. However, mom’s estate couldn’t prove that Anthony was entitled to any pay or how much his services were worth.

There was no contract, no invoice, and no evidence the family agreed to pay him anything. Sure, Anthony gave round-the-clock care. The family would have hired round-the-clock nurses if he hadn’t been there.

But he was, and the fact that a nurse would have been paid didn’t mean pay to Anthony was deductible. Anthony even considered billing the estate for his legal services.

After all, apart from his personal care and for administering the estate, he performed legal work too. He filed the estate tax return, handled an IRS audit and the estate’s Tax Court petition.

But here again, Anthony was out of luck. He didn’t keep time records, prepare invoices, or establish the value of what he did. He merely estimated his hours at a $150 hourly rate. That kind of loosey-goosey estimate wasn’t enough for a deduction.

The biggest lesson? Contracts, invoices, and good record-keeping are as important with family or related parties as anywhere else. In fact, perhaps there’s a bigger reason for being scrupulous with family and related parties: to save yourself headaches with the IRS. Happy Mother’s Day, Mom."

(Hat Tip: Attorney Robert Wood of Forbes)

Labels:

Deductions,

Estate Planning,

Tax Court Cases

Location:

Fresno (null)

Monday, May 6, 2013

Proposition 13: Buying Property Without Reassessment of Property Taxes

Recently, Michael Dell has been in the news quite a bit as the result of his purchase of the Fairmont Miramar Hotel for $200 million. In fact, the LA Times reported to its chagrin that while Michael Dell had bought the hotel, he was able to exploit a "loophole" in Proposition 13 that allowed him to keep the property tax base as if the property was only worth $86 million. By doing this, he was able to save over a million dollars a year in property taxes. When the LA County Assessor's Office read the Times article they conducted a review of their own. While LA County attorneys informed the assessor's office that Mr. Dell's transaction was not a change of ownership, the Assessor's Office challenged the transaction anyways. Recently, an LA Superior Court judge ruled in Mr. Dell's favor, holding that under plain language of the law, there was no "change of ownership" and could be no reassessment.

The Times, article, however, doesn't go into the details of how this was orchestrated and the law that applies. Generally, when there is a change of ownership, property is reassessed for property taxes. Now, when the property is owned by a legal entity, there are additional rules and complexities. Under the law, the general rule is that the mere transfer of an ownership interest in a legal entity does not constitute a change of ownership of the property in the entity. However, there are two main exceptions to this rule. The first is the "change in control" exception which provides that if a single person (or entity) acquires more than 50% of the entity, then there will be a reassessment. The second exception is called the "original co-owner" exception and provides that if the original owners of the entity cumulatively transfer more than 50% of their ownership interests in the entity to others, there will be a reassessment. However, this second exception only applies if the entity acquired the property after March 1, 1975 in a transaction that was not considered a change of ownership because the property was used to capitalize an entity. It was this curious requirement that worked in Dell's favor.

In particular, Dell's attorney's advised him that instead of buying the real property outright, he should instead by the LLC that owned the hotel. In particular, they had Michael Dell form a limited partnership that bought 42% of the LLC, they had Michael's wife set up a trust for her to buy 49% of the LLC and then the remaining 8.5% was bought by an investment entity owned by Dell's investment managers. Ordinarily, this transaction would easily fall under the "original co-owner" exception because you had the original owners of the LLC transfer 100% of there interests away. However, because the hotel had been purchased by the LLC (or potentially was capitalized before 1975), this exception could not apply and so there could be no reassessment. That left the Assessor's office relying on the first exception and so they argued that even though no single person owned more than 50% of the LLC, that there had been a change of ownership because Dell's interest and his wife's interest should be viewed as a single unit. Dell's attorney's countered that this would violate the plain language of the law and that husband-wife transfers have never constituted a change of ownership. The court ended up ruling in favor of Dell, which the Assessor's Office is expected to appeal.

The take-away is that if a buyer is interested in acquiring a property that has been owned by an entity since before 1975 (or purchased by the entitty thereafter), there are ways to structure the transaction so as to keep the low assessed value for property tax purposes.

Thursday, May 2, 2013

How Apple Saved Billions By Issuing $17 Billion in Bonds

Recently, Apple made headlines by issuing a massive amount ($17 billion worth) of corporate bonds. The main reason was to acquire sufficient funds to pay shareholders rather than having to bring back cash from Apple's overseas operations. While Apple has around $45 billion in holdings in the U.S., it has $100 billion parked overseas. Because it can be very expensive to repatriate these foreign funds, major corporations contort themselves to devise strategies to avoid paying this repatriation tax.

Below is a brief video highlighting the details of this strategy:

Below is a brief video highlighting the details of this strategy:

Wednesday, April 24, 2013

California High Speed Rail: How to Defer Paying Income Tax on the Sale of Your Property

The senior tax partner here at FLGZ, Bob Fishman, recently finished writing an article on the tax aspects of having your real property condemned by the High Speed Rail Authority to make room for California's impending high speed rail line.

Most landowners are unaware that such sales (and sales to third parties under threat of condemnation) have serious tax implications. First, the gain on the sale will be taxable to the landowner unless proper planning is done. Similar to section 1031 like-kind exchanges, section 1033 of the IRC code allows landowners who have property sold in a government taking to defer the recognition of the gain if they purchase similar property. However, there are elections and procedures that must be made under strict IRS time-tables.

If any landowner has received notice from the Rail Authority that their property is in the proposed rail path then they should consult a tax attorney and begin devising a game plan as how to best proceed. It is imperative to realize that both pre- and post-condemnation tax planning that will need to be done to ensure that the gain is properly deferred.

This is particularly true for landowners (and their attorneys) who are going to challenge and litigate over the "price" of the property. While landowners should ensure that they get a fair price for their property, they and their attorneys should consult with a tax attorney to ensure that no election and other deadlines are missed.

Mr. Fishman's article is scheduled to be published in the California Tax Lawyer magazine. In addition, there are 40 detailed examples reference in the article that go through various permutations to demonstrate some of the nuances of section 1033. A link to the 40 examples can be found here.

Most landowners are unaware that such sales (and sales to third parties under threat of condemnation) have serious tax implications. First, the gain on the sale will be taxable to the landowner unless proper planning is done. Similar to section 1031 like-kind exchanges, section 1033 of the IRC code allows landowners who have property sold in a government taking to defer the recognition of the gain if they purchase similar property. However, there are elections and procedures that must be made under strict IRS time-tables.

If any landowner has received notice from the Rail Authority that their property is in the proposed rail path then they should consult a tax attorney and begin devising a game plan as how to best proceed. It is imperative to realize that both pre- and post-condemnation tax planning that will need to be done to ensure that the gain is properly deferred.

This is particularly true for landowners (and their attorneys) who are going to challenge and litigate over the "price" of the property. While landowners should ensure that they get a fair price for their property, they and their attorneys should consult with a tax attorney to ensure that no election and other deadlines are missed.

Mr. Fishman's article is scheduled to be published in the California Tax Lawyer magazine. In addition, there are 40 detailed examples reference in the article that go through various permutations to demonstrate some of the nuances of section 1033. A link to the 40 examples can be found here.

Friday, April 19, 2013

Obama's Proposed Budget: Making the Death Tax More Deadly

So much for the "permanent" tax law changes that were just enacted a few months ago. President Obama's new budget now includes an increase in the estate tax along with other measures to make it more difficult for families with larger estates to pass assets onto their children.

In January, the President and Republicans agreed to tax estates at 40% with an exemption of $5 million per person (indexed for inflation). Obama's budget, however, proposes to raise the top rate to 45% and reduce the exemption to $3.5 million. This new exemption level would not be indexed for inflation which means that over time, smaller estates would begin to be hit with an estate tax.

In addition, the budget makes proposed changes to utilizing short-term GRATs as well as making gifts of family limited partnerships--techniques which have been used for years to minimize estate and gift taxes.

In January, the President and Republicans agreed to tax estates at 40% with an exemption of $5 million per person (indexed for inflation). Obama's budget, however, proposes to raise the top rate to 45% and reduce the exemption to $3.5 million. This new exemption level would not be indexed for inflation which means that over time, smaller estates would begin to be hit with an estate tax.

In addition, the budget makes proposed changes to utilizing short-term GRATs as well as making gifts of family limited partnerships--techniques which have been used for years to minimize estate and gift taxes.

Monday, April 15, 2013

Income Earned by Tribal Members on Reservations Now CA Tax-Exempt

The Franchise Tax Board has recently announced that tribal members who live on reservations and who receive income from reservation sources are not subject to California state income tax on that income. This position came as a response to several recent court cases where courts had to determine whether "reservation source income" should be interpreted broadly as income earned by a tribal member living and working on the reservation or more narrowly limited to income earned on the reservation and paid only by the tribe.

Thus, if a tribal member lives and works on the reservation, income earned by the tribal member, whether paid by the tribe or any other third party, is California tax-exempt.

If tribal members have been paying California taxes on this income, they are entitled to refunds going back approximately four years.

Thus, if a tribal member lives and works on the reservation, income earned by the tribal member, whether paid by the tribe or any other third party, is California tax-exempt.

If tribal members have been paying California taxes on this income, they are entitled to refunds going back approximately four years.

Wednesday, April 10, 2013

Why Mark Zuckerberg May Never Pay Taxes Again: Buy, Borrow & Die

CNN op-ed: Zuck Never Has to Pay Taxes Again, by Edward J. McCaffery (USC):

(Hat tip: Tax Prof Blog)So, you think you have it bad this tax season. Have you heard that Facebook founder Mark Zuckerberg will pay between $1 billion and $2 billion in taxes? That sounds like a tough pill for anyone to swallow.But it is premature to start a pity party for Zuckerberg. The twenty-something billionaire reaped large financial gains from exercising the stock options that triggered his tax bill, and he has benefited from favorable tax rules along the way. Even better, Zuckerberg will survive his encounter with the tax man in a position to never have to pay taxes again for the rest of his life. ...The truly rich do not have to pay any tax once they have their fortunes in hand. They can follow the simple tax planning advice to buy/borrow/die: Buy assets that appreciate in value without producing cash (like shares of Internet stocks), borrow to finance lifestyle, and die to pass on a "stepped up" basis to heirs wherein the tax gain miraculously disappears.Zuckerberg now has $11 billion or more with which to play this game. He can live off money borrowed against that huge sum (rest assured, he can get good interest rates), never having to sell any asset at a gain, and never having to get an "ordinary" salary again.

Monday, April 8, 2013

The Unflappable Iron Lady

In honor of Margaret Thatcher's life I have attached a short clip of a British House of Commons debate with the Iron Lady taking on any who wished to step into the ring with her. Too bad we don't have any similar forum here in the U.S.

Monday, April 1, 2013

California Has A Negative Net Worth in the "Hundreds" of Billions of Dollars

The Sacramento Bee has a headline that reads: "State auditor: California's net worth at negative $127.2 billion".

As troubling as that headline is, the most startling material is buried in the last paragraph of the article:

As troubling as that headline is, the most startling material is buried in the last paragraph of the article:

The list of long-term obligations did not include the much-disputed unfunded liabilities for state employees' future pensions, nor the $60-plus billion in unfunded liabilities for retiree health care. The Governmental Accounting Standards Board and Moody's, a major bond credit rating house, have been pushing states and localities to include unfunded retiree obligations in their balance sheets and were they to be added to California's, it could push its negative net worth down by several hundred billion dollars.

Wednesday, March 27, 2013

High-Speed Boondoggle? $800 Million to Save 10 Minutes

Admit it. When the federal government talks of investing huge sums of money into high-speed rail you picture aerodynamic bullet trains humming along at 220 miles per hour.

So when the government proclaims that it has invested $12 billion into "high-speed rail" you presume that those funds will be used to fund actual high-speed rail projects. Not so says CNN's Drew Griffin who has released another expose on where these funds are actually going.

To sum up Drew's report, the $12 billion dollars is being used to make conventional freight trains a wee bit faster. In essence, while the public was sold on bullet trains, the monies are really just being used to improve conventional rail lines.

The cornerstone of Drew's report is the fact that $800 million in taxpayer "high-speed rail" funds were used to improve conventional rail track between Seattle and Portland. The big pay-off? Shaving 10 minutes off the travel time.

The CNN video report can be seen here.

So when the government proclaims that it has invested $12 billion into "high-speed rail" you presume that those funds will be used to fund actual high-speed rail projects. Not so says CNN's Drew Griffin who has released another expose on where these funds are actually going.

To sum up Drew's report, the $12 billion dollars is being used to make conventional freight trains a wee bit faster. In essence, while the public was sold on bullet trains, the monies are really just being used to improve conventional rail lines.

The cornerstone of Drew's report is the fact that $800 million in taxpayer "high-speed rail" funds were used to improve conventional rail track between Seattle and Portland. The big pay-off? Shaving 10 minutes off the travel time.

The CNN video report can be seen here.

Friday, March 22, 2013

Is My Fresno County CSA 51/283 Tax Assessment Deductible as a Property Tax? (Part I)

Most everyone knows that regular annual property taxes are deductible for federal income tax purposes (ignoring AMT issues). However, what is often confusing to homeowners and tax preparers is the deductibility of certain extra one-time assessments used to fund public improvements (often called local benefit assessments).

For example, many homeowners that live in northern Fresno County live in an area referred to as County Service Area 51. CSA 51 was established to try to figure out if there was a viable way to bring city water to the low water areas of northern Fresno. CSA 51 ended up creating assessment district 283. Back in 2008 or so, the then residents of CSA 51 voted to have certain engineering plans drawn up to determine the feasibility of bringing water to that area--as part of this, it was agreed that the cost of such plans would be assessed to each parcel in the area (around $3,000 per house). Maps and plans were drawn up the final report indicated that it would cost each homeowner a whopping $50,000 or so to have water lines installed in the area. The CSA 51 residents then voted again in July of 2012 to see if the project (and the massive $50,000 per parcel assessment) would move forward. The measure ultimately failed.

The CSA 51 residents were left with engineering plans, a $3,000 per parcel assessment, but no water lines. Half of this $3,000 assessment (or around $1,500) recently showed up on homeowners' 2012-13 property tax bill (referred to as CSA ID 283), with the other half to be assessed next year.

The obvious question for the CSA 51 homeowners is "can I deduct this extra $1,500 in property taxes this year and again next?"

Unfortunately, the answer is NOT easy.

The deductibiliy of local benefit assessments really depends on the purpose of the assessment. Taxes assessed against local benefits of a kind tending to increase the value of the property are deductible as taxes only to the extent taxes are properly allocable to repairs, maintenance or interest charges. (Reg. 1.164-4(b).)

Thus, it has long been established that local assessments to build sewer or water lines, sidewalks, or irrigation lines benefiting a particular community, as opposed to the entire city or county, would be non-deductible. The idea is that these assessments benefited a select group of people and increased the values of their property.

However, the key fact in this case is that the project in CSA 51, never actually moved forward. Had the lines been built, there is no question that the initial $3,000 assessment and the additional $50,000 assessment would not have been deductible, but here, the operative question is whether or not the residents of CSA 51 have enjoyed some type of increase in value, simply by virtue of the fact that the county has had expensive engineering maps and plans drawn up.

Believe it or not, there is an old tax case from 1941 which addresses a similar situation (Thatcher v. Commissioner (1941) 45 BTA 64). In the Thatcher case a special assessment district was created to consider the installation of a sewer line in the neighborhood. After its creation, expenses were incurred for engineering services, attorney fees, and other expenses related to the planned sewer construction. As a result, general plans and maps were made, but the Court noted that there were no detailed plans for construction purposes. Shortly after, it was determined that the plan was misguided and the assessment district was disbanded. The question the court entertained was, what value did the residents get from these plans that had been drawn up. The residents claimed that because the construction was not moving forward, the plans held no value for future use and that they were simply paying for a "mistake in judgment". The IRS argued, however, that the plans and maps resulting from the expenditures had a value for future use and constituted a benefit to the residents.

The court ultimately relied on the fact that the construction project was not moving forward and stated as follows:

In other words, when the city determined that it was too expensive to feasibly construct sewer lines, this would actually have decreased the values of the home. In short, the court decided that while there may be some value to having plans drawn up, if the plans actually show you that the end goal is prohibitively expensive and the project is ultimately dropped, there can be no "benefit" to the residents. The residents won and were allowed to deduct the assessments

With respect to the residents of CSA 51, there is no clear answer. While the facts and circumstances of CSA 51 are similar to the Thatcher case, they are not identical.

For example, many homeowners that live in northern Fresno County live in an area referred to as County Service Area 51. CSA 51 was established to try to figure out if there was a viable way to bring city water to the low water areas of northern Fresno. CSA 51 ended up creating assessment district 283. Back in 2008 or so, the then residents of CSA 51 voted to have certain engineering plans drawn up to determine the feasibility of bringing water to that area--as part of this, it was agreed that the cost of such plans would be assessed to each parcel in the area (around $3,000 per house). Maps and plans were drawn up the final report indicated that it would cost each homeowner a whopping $50,000 or so to have water lines installed in the area. The CSA 51 residents then voted again in July of 2012 to see if the project (and the massive $50,000 per parcel assessment) would move forward. The measure ultimately failed.

The CSA 51 residents were left with engineering plans, a $3,000 per parcel assessment, but no water lines. Half of this $3,000 assessment (or around $1,500) recently showed up on homeowners' 2012-13 property tax bill (referred to as CSA ID 283), with the other half to be assessed next year.

The obvious question for the CSA 51 homeowners is "can I deduct this extra $1,500 in property taxes this year and again next?"

Unfortunately, the answer is NOT easy.

The deductibiliy of local benefit assessments really depends on the purpose of the assessment. Taxes assessed against local benefits of a kind tending to increase the value of the property are deductible as taxes only to the extent taxes are properly allocable to repairs, maintenance or interest charges. (Reg. 1.164-4(b).)

Thus, it has long been established that local assessments to build sewer or water lines, sidewalks, or irrigation lines benefiting a particular community, as opposed to the entire city or county, would be non-deductible. The idea is that these assessments benefited a select group of people and increased the values of their property.

However, the key fact in this case is that the project in CSA 51, never actually moved forward. Had the lines been built, there is no question that the initial $3,000 assessment and the additional $50,000 assessment would not have been deductible, but here, the operative question is whether or not the residents of CSA 51 have enjoyed some type of increase in value, simply by virtue of the fact that the county has had expensive engineering maps and plans drawn up.

Believe it or not, there is an old tax case from 1941 which addresses a similar situation (Thatcher v. Commissioner (1941) 45 BTA 64). In the Thatcher case a special assessment district was created to consider the installation of a sewer line in the neighborhood. After its creation, expenses were incurred for engineering services, attorney fees, and other expenses related to the planned sewer construction. As a result, general plans and maps were made, but the Court noted that there were no detailed plans for construction purposes. Shortly after, it was determined that the plan was misguided and the assessment district was disbanded. The question the court entertained was, what value did the residents get from these plans that had been drawn up. The residents claimed that because the construction was not moving forward, the plans held no value for future use and that they were simply paying for a "mistake in judgment". The IRS argued, however, that the plans and maps resulting from the expenditures had a value for future use and constituted a benefit to the residents.

The court ultimately relied on the fact that the construction project was not moving forward and stated as follows:

We do not agree with respondent's contention that the mere fact of the determination that the construction of a sewage system in the district was not feasible or too costly is a benefit. It may be a benefit to the present owner personally, in the sense that it will deter him from ever taking part in such a project again, but we can conceive of no reason for an increase in the value of the land by reason of a determination that it is not subject to sewage development except at a prohibitive cost. The natural effect of this, we think, is to decrease values.

In other words, when the city determined that it was too expensive to feasibly construct sewer lines, this would actually have decreased the values of the home. In short, the court decided that while there may be some value to having plans drawn up, if the plans actually show you that the end goal is prohibitively expensive and the project is ultimately dropped, there can be no "benefit" to the residents. The residents won and were allowed to deduct the assessments

With respect to the residents of CSA 51, there is no clear answer. While the facts and circumstances of CSA 51 are similar to the Thatcher case, they are not identical.

Thursday, March 21, 2013

The Tax Consequences of Superman's Diamonds

Chances are, you have often pondered the tax implications of Superman using his super human strength to turn coal into diamonds--which he has done on several occasions.

From the Tax Prof Blog:

[I]f Superman crushes carbon and makes diamonds, is that taxable income? ... There are two questions here. First, are the diamonds taxable income for Superman (or Clark Kent) and second, are they taxable income for a recipient such as Lois Lane?The answer to the first question is “probably not.” A traditional, almost fundamental principle of income tax is that a gain in value must be realized before it can be taxed. ...It seems clear that improving the value of the carbon is not such a taxable event, since there is neither a sale nor disposition of the property of any kind. An analogy might be made to a painting that appreciates in value; the increase in value is not taxed until the painting is sold, given away, etc.If the diamonds are given to Lois Lane, however, that is obviously a gift, which has its own set of special rules. In the US, gifts are generally not taxable income for the recipient. 26 USC 102(a). But there is a gift tax that is ordinarily paid by the giver. 26 USC 2501(a)(1) and 26 USC 2502(c). However, there is a significant exclusion for gifts that currently stands at $13,000 per-recipient per-year. Thus the question is, presuming the diamonds were given as a gift today, would they exceed the exclusion?Obviously this depends on the size and quality of the diamond and the state of the diamond market, but for example the diamond given to Lana Lang in Superman III appears to be about 3.5 to 4 carats and of very good quality. Looking at stones for sale on Blue Nile, a similar diamond would cost somewhere between $150,000 and $400,000, depending on the particulars, which is far beyond the gift exclusion. So how much would Superman be on the hook for? The answer is “a lot.” ...Superman could theoretically avoid gift tax liability by performing the gratuitous service of crushing coal into diamonds rather than giving a finished diamond. Although it is true that gratuitous services are not taxed, it is also true that the IRS and the courts frown on tax avoidance schemes that attempt to exalt form over substance. Gregory v. Helvering, 293 U.S. 465 (1935). So a scheme by which Superman handed someone a piece of coal, fully intending to turn it into a diamond, then did so, would be tantamount to simply giving them a diamond. The IRS would focus on the substance of the transaction, not the form, and consider it a taxable gift of property.But if, for example, Superman were at someone’s house for a barbecue and decided to thank them for dinner by crushing a lump of their own charcoal into a diamond, that would be different. In that case Superman really would be performing a gratuitous service. ...Superman has crushed coal into diamonds for various reasons, but one of the best known was his gift of a ring to Lana Lang in Superman III. This raises an interesting question: is an engagement ring subject to gift tax? There is, subject to certain qualifications, an unlimited marital deduction for gifts between spouses, but what about an engagement ring, which is given in anticipation of marriage?The law surrounding engagement rings and other pre-nuptial gifts has a long and complex history, dating back to at least the Romans. Most of the law has to do with who owns such gifts, particularly if the marriage is called off. But it turns out that none of that matters for tax purposes. If the donor and donee aren’t married at the time of the gift, then the marital deduction doesn’t apply. 26 U.S.C. § 2523(a). So an engagement ring is subject to gift tax, even if the donor and donee get married later that same year. In practice I suspect that few people actually report such gifts, even in the rare case where it would make a difference in their ultimate tax liability, but maybe Superman would actually be moral enough to do so.Crushing coal into diamonds still doesn’t create tax liability for Superman, and he still has some ways to avoid liability if he crushes coal into diamonds for other people, but he has to be careful about it. And strictly speaking he probably should have reported that ring he gave to Lana.

Saturday, March 16, 2013

A Depressing Look at the CA Sec. of State's Office: why it takes CA 43 days to do what TX does in 5

I've always wondered why it takes week for the CA Sec. of State's Office to process business filings. Often these delays prevent business owners from getting licenses and opening bank accounts. I was surprised to learn (not really though) that it only takes New York seven days and Texas five days to process similar filings.

Recently, Debra Bowen, the Secretary of State was grilled in front of the CA legislature and it wasn't a pretty picture. It revealed an office so out of date that it actually relies on 3 x 5 index cards as its filing system.

More from the OC Register:

Recently, Debra Bowen, the Secretary of State was grilled in front of the CA legislature and it wasn't a pretty picture. It revealed an office so out of date that it actually relies on 3 x 5 index cards as its filing system.

More from the OC Register:

"I almost needed smelling salts the first day I took a tour of the Secretary of State's office," said Bowen, a former Marina Del Rey legislator who was first elected California's chief elections officer and business records clerk in 2006. "It was just so incredibly paper-driven."

Bowen's office has taken heat in recent days after it was revealed that her staff was taking 43 days to process business filings. As Assembly Budget Committee staff reported, this backlog delays businesses from starting up or hiring employees and postpones business tax payments.

New York processes such documents in seven days, committee staff found. Texas, five days.

"There is a scoreboard," Daly said, referring to the other states' better turnaround times. "At some point, the time for excuses is over."

Bowen says her office needs $8.9 million in new money over the next fiscal year, and millions more after that, to fund dozens of new staff positions necessary to handle the workload and reduce the backlog until a new, digital filing system comes online in 2016.

That new system, known as California Business Connect, will create a central records database and put the Secretary of State's services on the Internet. But Bowen complained that the state's procurement process is needlessly protracted and requires her to spend "a ridiculous amount of money" just on the paperwork to "get the project on the docket to get done."

"We spend a year getting the feasibility report done. Then it takes a several months after that to hire a contractor to write the request for proposal. That's another three to four months – it could be even longer than that," Bowen told the subcommittee. "That one was approved by the Legislature in July of 2011. The request for proposal, the RFP, was released in August 2012. Draft bids from vendors were submitted in late January of this year and are currently being reviewed.

"So ... the normal processing time for a large IT project ... you get to 2016," she said. "That has to be changed."

Further complicating matters, Bowen said, is her office building's lack of outlets and her staff's requirement to use the state Department of General Services to procure rewiring services. She specifically asked the committee for authority to pursue the rewiring on her own, without the assistance of the department, which acts as the "business manager" for other state agencies.

Friday, March 15, 2013

Explaining the Debt Limit: How an Absurd Video Makes the Debit Limit Debate Understandable

This video is a must see and pretty much explains itself:

Tuesday, March 12, 2013

California Fire Prevention Fees Are Not Tax Deductible Says IRS

California has begun mailing bills to rural property owners for fire prevention. If you own habitable property the CalFire's jurisdiction, you will eventually receive two bills this year--one for the State's 2011-2012 fiscal year, and one for its 2012-2013 fiscal year.

Each bill will be $150 per habitable structure on your property. So if you have one house on your property and no other habitable structures, you will receive two bills this year totaling $300.

The Howard Jarvis Taxpayer Association warns:

Unfortunately, it appears the IRS has taken the position in a recent Memorandum that such payments are not deductible property taxes.

Office of Chief Counsel, IRS Memorandum 2013-10-029 (Jan. 14, 2013) (released Mar. 8, 2013):

Each bill will be $150 per habitable structure on your property. So if you have one house on your property and no other habitable structures, you will receive two bills this year totaling $300.

The Howard Jarvis Taxpayer Association warns:

PAY CLOSE ATTENTION TO THE DUE DATE. You may have fewer than 30 days to pay. If you are late, there is a 20% penalty, plus interest. Every 30 days after that, another 20% penalty is added, plus interest. The fee is a lien on your property, and failure to pay can result in foreclosure.

Unfortunately, it appears the IRS has taken the position in a recent Memorandum that such payments are not deductible property taxes.

Office of Chief Counsel, IRS Memorandum 2013-10-029 (Jan. 14, 2013) (released Mar. 8, 2013):

Issue: May California residents deduct the Fire Prevention Fee they may pay on their federal income tax returns as a real property tax deduction under section 164 of the Internal Revenue Code and § 1.164-4 of the Income Tax Regulations?Conclusion: California residents may not deduct the Fire Prevention Fee as a real property tax deduction because (i) the fee is not a tax under California or federal law (ii) the fee is not levied at a like rate, (iii) the fee is not imposed throughout the taxing authority's jurisdiction, and (iv) the fee is assessed only against specific property to provide a local benefit

Thursday, March 7, 2013

Camp Taylor--Helping Kids With Heart Disease

Michael Goldring from our office and his daughter, Rachael, were featured on KSEE 24 recently to talk about heat disease on how children who suffer from it can benefit from Camp Taylor.

Click here for their video appearance.

Click here for their video appearance.

Friday, March 1, 2013

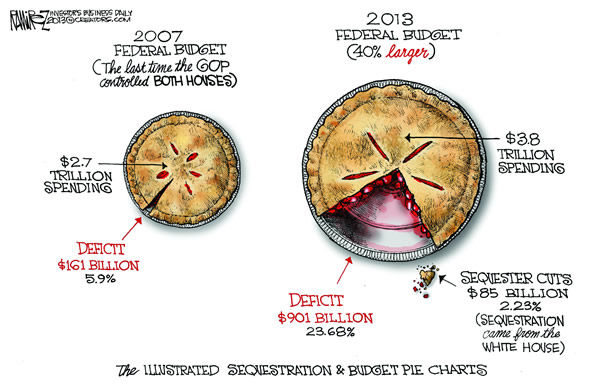

A Sequestration Visual Aid

Cartoonist Michael Ramirez offers a helpful visual of the level of planned cuts under Sequestration.

Pies Illustrated, by Michael Ramirez (February 26, 2013)

Boomerang, by Michael Ramirez (February 25, 2013)

Oscars Red Carpet, by Henry Payne (February 23, 2013)

Subscribe to:

Posts (Atom)